SHARE

Deductr: The Tax Deduction Tool for Independent Business Owners

At the birth of this nation Benjamin Franklin was quoted as saying, “Our new Constitution is now established, and has an appearance that promises permanency; but in this world nothing can be said to be certain, except death and taxes.” There are many who would suggest death to be the less painful of the two. Taxes affect everyone in one form or another but if you’re just starting your first MLM business, you might be surprised to learn about the tax benefits of your new position. If you start tracking your tax-deductible events today, you can start saving money—potentially much more money than you’ll earn on commissions in your first year.

For the small business owner, sole proprietor, independent contractor, or home-based business owner the tax code and its associated IRS regulations can be a daunting and expensive obstacle. Starting a home-based business is one way to increase tax deductions. You can shift many personal expenses to business expenses and thereby lower your taxable income. The result is a net increase in what you can legally and ethically “take home” when it comes to income. Taking advantage of the tax laws in this way isn’t simple, but using Deductr can make it simple.

What is Deductr?

Deductr’s core strength is to help the independent business owner (I call them IBOs). We help IBOs to file correctly and to get the greatest possible return. The IRS is cracking down on small home businesses that file incorrectly. They write their entire home off—you can’t do that. They write off their clothes—you can’t do that. They think because they buy a shirt with the company name on it, they can deduct the shirt—they can’t. They just don’t know what is and isn’t deductible and with a tax code nearly 75,000 pages long, it’s really not surprising that any American finds taxes incomprehensible. Our purpose at Deductr is to do all that heavy lifting for you.

Who is Deductr for?

When I speak or go to an event and we roll out Deductr, my first focus is really on the new startup distributor. If this is your first time in business for yourself, we’re going to help you maximize the benefit of being self-employed. Everybody thinks that the person who needs Deductr is the person making lots of money. That couldn’t be further from the truth. The person making a lot of money can afford an accountant. The person who just got started, who’s never been in business for herself before gets the greatest benefit from Deductr.

You may only make $1000 in your first year. You may only make $500. But what Deductr will do is show you in real time how much you’re going to get back as a direct result of having your own business. There are deductions that you get that will—without any question—put more money back in your pocket on your tax return than you got the year before and it’ll probably be four or five times what you earn from your first year in business. Let me repeat that because it’s important.

Now that you own a business you will get more back than you got last year and you’ll probably get more back than what you earn in commissions.

How is that possible?

When I explain this to people, they often wonder how that’s even possible. If you’ve worked as a W2 employee your entire life, you have no frame of reference for what taxes look like to independent business owners.

The write offs you take as a W2 employee are minimal. You can write off interest on your home, charitable contributions that you made, and HSA contributions. But you can’t write off your laptop or your cellphone or the miles that you drive to work. As an independent business owner you can write off all of those things.

As small as your business might be in the beginning, you get a lot of write-offs. Say one day, on your way to work, you stop to you meet somebody for breakfast and during breakfast you talk about your new business. Those miles are now a write off. At $.54/mile, it adds up. If you do 100 miles in a week (which is really simple to do) all of a sudden you got $200 a month—just on the mileage—coming back to you on your tax return. If you use Deductr’s calendar to schedule those little business building endeavors, you can input all of the details as you go and then create your tax documents with a few clicks at the end of the year. No more digging through a shoebox of receipts when you file.

You can actually operate at a loss for 3 years while getting the tax benefit of being a small business owner. You have time to build your business and while you’re doing that you can get money back. A huge number of people get discouraged by the amount of time it can take to build an income in direct sales, but if they only knew how much they could save on their taxes, maybe they’d stick with it longer—long enough to really start making money.

Deductr can keep you motivated

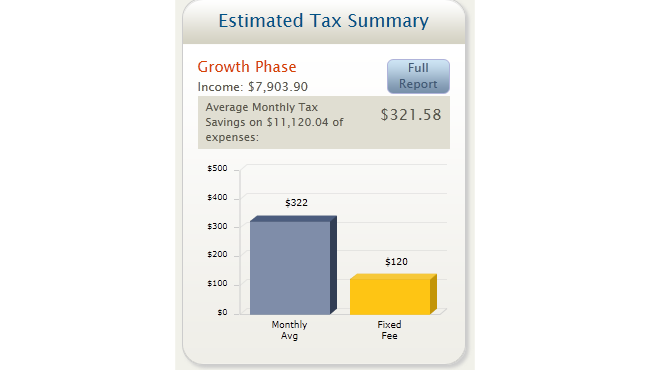

Deductr shows you in real time how much you’re putting back in your pocket in tax savings. Having that information can keep you motivated—keep you engaged in the process. Most people drop their autoship within 2–3 months of joining and the reason is that they think they’ve made no money. But we show you—in real time with a blue bar—your tax-return monthly savings and it’ll usually be anywhere from 2–4 times the amount that you’re paying toward your autoship.

A lot of companies are lowering the cost of autoship. I’m seeing autoships as low as $40 now—which never used to be the case. But on average autoship is around $100. If you put $250 back into your pocket every month, your autoship is free. Why would you drop your autoship if your tax return was covering the cost outright?

Your company cannot guarantee you what you’re going to make by the end of the year. No one can guarantee you what you’ll get back on your tax return either but I can tell you that our average user puts $3000-6000 back into their pocket. The caveat is that you have to use it. The main reason why we see users saving less than that is because they just didn’t track their business building efforts like they should. But for the people who use it, it’s incredible.

How does Deductr help?

The IRS wants three things really. They want to see your expense write offs in detail, they want to see your mileage in detail, and they want evidence that you intend to make a profit. The intent to make a profit is the big one. They want to see documentation of the time you’ve invested as you work toward a profit. “Show me. How many meetings did you do? How many prospecting hours did you put in?”

What the IRS cares about is that you keep a ledger. If you get audited and you said you had 3500 miles, you better have a ledger showing it. They won’t fine you for not having a ledger, they’re just going to say, “no deductions for you. Because you lied on this, you’re probably lying about most things.” And they will drag it out and force you to spend time and money on an accountant to fight your battle because you just basically didn’t have documentation.

Deductr is designed to make it easy for you to demonstrate each of these three things—all of that is built into our app. You can put all of your meetings and events into the calendar, log mileage in the moment with GPS (or manually after the fact), and track business expenses automatically by connecting your bank.

If you use Deductr as you go along building your business, creating that ledger is easy. The most relevant benefit of Deductr is that we create the Schedule C—the document that you’re required to submit when you file a 1099. You could survey 100 people in network marketing and ask them what a Schedule C is and I guarantee you 85% have got no clue what you’re talking about and then there’s half of them that don’t even know what a 1099 is. They’ve been W2 employees their whole lives and that’s all they know. But you don’t need to invest time and energy learning how to file if you let Deductr do that work for you.

Treat it like a business

Most don’t make a profit when they start their MLM business because they don’t like sales but they love the product and they love the social experience. I think people get involved to belong to something. It’s interesting. That social connection is really important. But with a small adjustment in the way you think about your business you can get the social benefits and money back on your taxes, while at the same time increasing your efforts at making an actual profit.

I like to call MLM distributors independent business owners (IBOs). The industry uses so many different titles—associates, consultants, etc.—but I use IBO because I believe that centering individuals on the idea of being independent business owners creates a beneficial mental shift. If you will learn to treat your business like a business, then it’s going to pay you like a business and not like a hobby.

If you just make that one adjustment—if you just say “I am in business for myself now, so I’m going to treat it like a business”—it can make a world of difference.

Check with your company to see if they already offer Deductr to their distributors—quite a few MLMs do. If not, you can try it out for 60 days for just $1.

you may also like

Essential Software Customizations for MLM, Direct Selling, and Affiliate E-commerce

Navigating the changing landscape of e-commerce, particularly within MLM, direct selling, and affiliate marketing channels, requires more…

How to Ensure Your Compensation Plan and Software Work Well Together

Peanut butter and jelly. Milk and cookies. Batman and Robin. Everybody knows these famous pairings work well…

Podcast 53: Advantages Using an Interim VP of Sales for Direct Selling Companies

Today we welcome a returning guest of this podcast: Jeff Jordan. Jeff has also written articles for…

compensation consulting for mlm companies

We offer data-driven compensation plan design & analysis

MLM.com Newsletter

Get our e-mail newsletter, with MLM.com articles & online exclusives, delivered to your inbox each week.